estate tax changes over time

See what makes us different. The revenue portion of the Build Back Better Act BBB that is moving along dramatically changes the landscape for transfer taxes ie.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Tax rates imposed on income realized when an asset is sold vary based on the type of asset.

. REC our list specifies one-time and time-limited changes as well as the portion of the impact on both state and local revenues. On 1 January 2013 absent further action by Congress the estate tax rate will reset to. The exemption is the amount that each person is permitted to pass on free of any federal estate tax at death.

Fisher Investments has 40 years of helping thousands of investors and their families. Changes in Estate Tax Over Time. The current estate tax exemption is 12060000 and double that amount for married couples.

Changes in Estate Tax Over Time. Get help planning your estate so your loved ones can avoid additional probate and taxes. However the law did not make these changes permanent and the estate tax returned in 2011.

These taxes were rolled back following the war in five. Increased to 5 and separate taxes were introduced for estates and excess business profits. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022.

This piece of mind however severely decreases after December 31 2025. For over 80 years our goal has remained the same. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts.

The exemption is the amount that each person is permitted to pass on free of any federal estate tax at death. Under the tax reform law the increase is only temporary. Haverford has more than 30 years of experience in trust administration.

Ad Haverford provides personalized service that protects the value of the estate or trust. List of the estate and gift tax proposals gives the date each proposal was eventually enacted in some form. This is why estate planning should include consideration of income tax issues.

As Chart 3 shows in 1916 only estates over 1 billion in todays wealth would have been taxed at the top rate of 10 percent. In 2022 theres a 1206 million exemption per person for gifts and estate taxes meaning you wont owe federal levies for giving away 1206 million or less to your children or other non. The estate tax is imposed only on the part of the gross non-resident aliens estate that at the time of death is situated in the United States.

The Democrats new plan would have the estate tax kick in at 2 million up from the current 1 million. Individuals can transfer up to that amount without having to worry about federal estate taxes. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Estate planning requires adjustments over time especially in light of tax law changes. Most people focus on the federal estate tax but there are. Accelerating the scheduled reduction in.

Unification of the gift and estate taxes. It would also eliminate the current cliff. The Estate Tax is Reimposed.

The number of people paying taxes in the US. The tax reform law doubled the BEA for tax-years 2018 through 2025. The applicable exemption from the estate tax is 5 million and is indexed to adjust for inflation after 2011.

Gas and Transportation Taxes. How did the tax reform law change gift and estate taxes. Contrast that with the top rate of 55 percent on estates of 3.

The Fight Over Taxing Inherited Wealth Princeton University Press February 2005 hardcover 372. Ad Protect your assets with a well-thought estate plan. However the law did not make these changes permanent and the estate tax returned in 2011.

In 2022 it rises to 1206 million. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Impacts listed as insignificant.

The new law establishes that the estate tax rate is 35 beginning 1 January 2011 and continuing to 31 December 2012. To improve lives through tax policies that lead to greater economic growth and opportunity. The Westport Democrat said senators want to raise the estate tax threshold from 1 million to 2 million while also providing a uniform tax credit of 99600 to estates above that figure to wipe.

The House of Representatives will likely pass its 523 million tax break package Wednesday afternoon despite pushback from some liberal lawmakers upset over the rewrite of the states estate tax. Taxation of appreciation at death or at the time of gifts carryover basis enacted in 1976 repealed in 1980 and enacted again in 2001 effective only for 2010. Last law to change rates was the Tax Cuts and Jobs Act of 2017.

Tax Changes Over Time. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. A roll-back of motor vehicle license taxes and property tax constitutional amendments and reductions have been particularly visible.

We dont make judgments or prescribe specific policies. The current exemption doubled under the Tax Cuts. The Modern Estate Tax Evolves.

There is an easy one-size-fits-all rule when it comes to basis planning.

Time And Money Hourglass Required Minimum Distribution Estate Tax Retirement Planning

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan How To Plan Irs

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Train Package 1 Train Package Estate Tax Train

Find The Best Wills And Estate Planning Lawyer In Ca Estate Planning How To Plan Estates

Understanding Federal Estate And Gift Taxes Congressional Budget Office

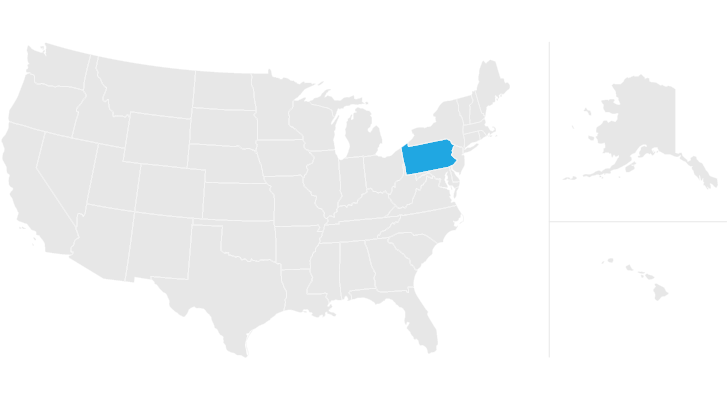

Pennsylvania Estate Tax Everything You Need To Know Smartasset

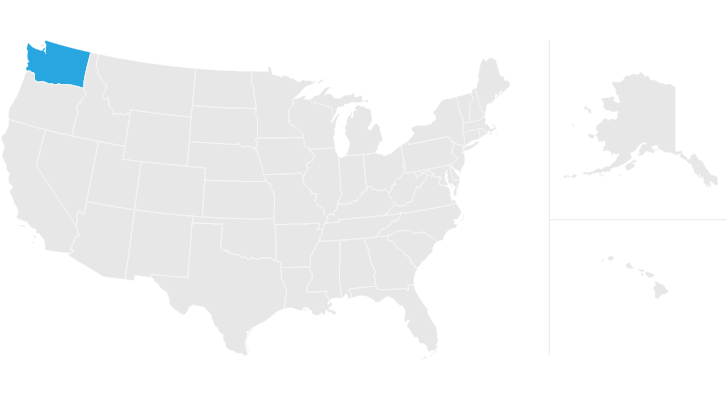

Washington Inheritance Laws What You Should Know Smartasset

The Real Estate Tax For The Seller Is Changing In 2020 Excisetax Excisetaxlaw Newlaw Homesellers Homebuyers Vanco Estate Tax Whatcom County Real Estate

New Estate And Gift Tax Laws For 2022 Youtube

Tax Savings Is Just One Of The Many Benefits Of Homeownership These Are Some Of The Items That Can Be Home Ownership Real Estate Tips Estate Tax

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax County

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Property Tax Map Tax Foundation

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)